The introduction of effective vaccines, like the ones developed by Pfizer and Moderna, have probably set the course for what could be an interesting 2021, as the world emerges from a pandemic that has ended up confining people within their homes for months.

Tech companies like Amazon, Google, and Facebook have been among those that have benefitted substantially from this situation, as the so-called ‘digital transformation’ has accelerated the way we connect, shop, and word in a way that nobody could have foretold.

In this context, business consultant Jasdeep Singh has some comments to share in regards to the future of tech stocks in this post-vaccine world.

Performance of tech stocks during 2020

Tech stocks – as reflected by the tech-heavy Nasdaq 100 stock index – have performed quite remarkably during the year. The pandemic has fueled the growth of businesses like Facebook, Microsoft, Amazon, and even Tesla – which are among the top constituents of this broad-market index.

Delivering a 44% annualized performance since the year started, nobody can argue how great business has been for those investing in tech stocks during 2020. This contrasts sharply with the unprecedented economic downturn the world has been swept into during the pandemic.

However, as vaccines begin to be rolled out around the world, one could argue that the prospect of ever-growing tech businesses has been capped. While fewer people in the future will be required to return to a physical office, enough will and that may affect how remote communication purchases are made and distributed. Basically, the need for such large investments in each and every worker’s accessibility may reduce the revenues of some tech companies.

On the other hand, it can also be argued that it will be difficult for businesses to take the foot off the pedal when it comes to the digital transformation whirlwind the pandemic has triggered. People have become accustomed to the multitude of ways they can be productive and taking those options away may hurt companies in the long run.

These two perspectives set up a situation that has investors scrambling for direction on where current strong performers may be headed next year.

Research firms agree that digital transformation is happening fast

Global research firm McKinsey & Company has recently published a study called “How COVID-19 has pushed companies over the technology tipping point—and transformed business forever”, in which they highlight that “digital adoption has taken a quantum leap at both the organizational and industry levels.”

Among their findings, McKinsey showed that the average share of consumers who had digital interactions in July 2020 grew to 58%, up from a previous 36% recorded in December 2019.

This accelerated “digital adoption” has been even more dramatic in North America, where that same share jumped from 41% last December to as much as 65% in July.

Meanwhile, to see how these changes will look once the virus crisis is over, it was astounding to see that a significant portion of those who responded to McKinsey’s survey thought the current digital adoption was here to stay.

Notably, 62% of those surveyed said that changes in customers’ needs and expectations – mostly associated with the convenience of online shopping – will stick, while over 50% also think that remote working and cloud-based work environments will become part of our regular lives.

Now, you might be thinking, what does this say about the future tech stocks?

According to Singh, who holds an MBA from the University of Connecticut, the McKinsey survey respondents’ answers could be the strongest indication that the tech rally will continue to have legs. If people are confident in their current digital usage and future adoption, technology companies will continue to take the lead in the business world, and in our homes, even after the pandemic.

A closer look at the price action seen by the Nasdaq 100 index

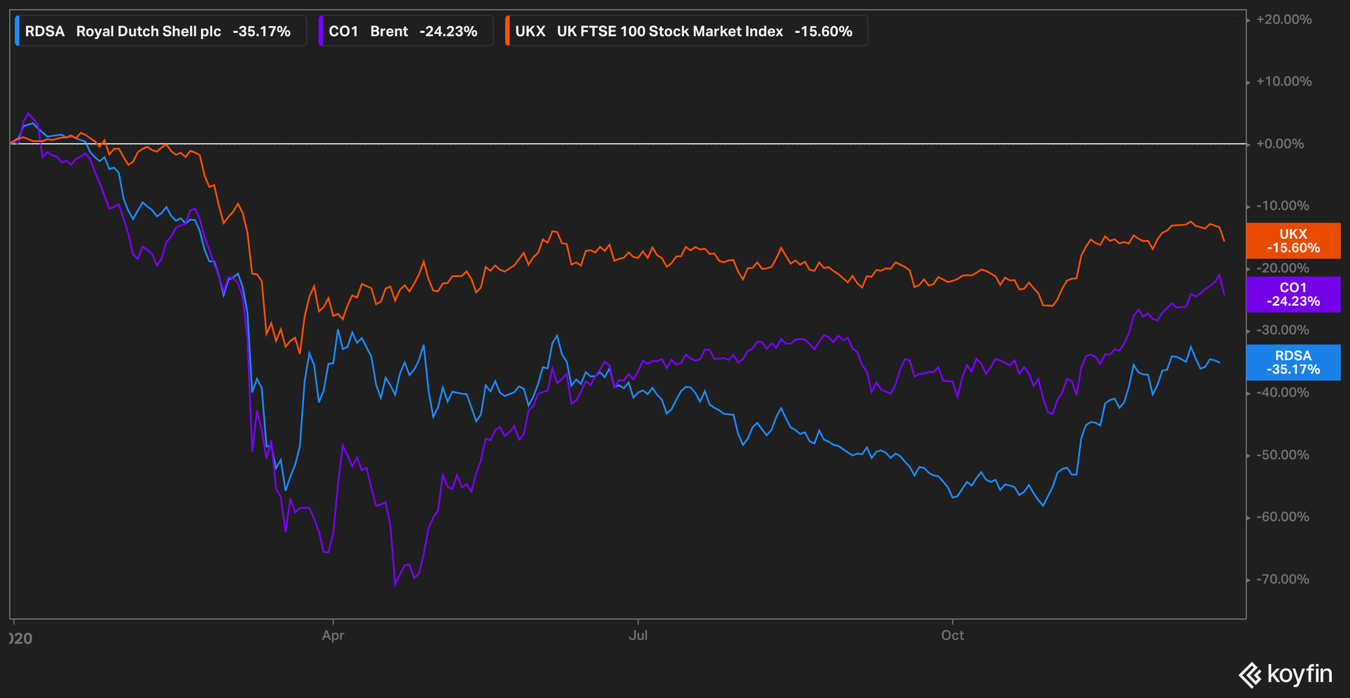

The chart shown above highlights the performance of the Nasdaq 100 index during the year, marked by a strong uptrend since the price emerged from its March low.

This uptrend recently cleared an important ceiling in early September: reaching a new all-time. Even more positive is that the price now seems to be consolidating just a notch above that threshold.

Given the positive backdrop that tech stocks currently have, it is plausible to think that there is not much that can hold them back.

First, their businesses are much less sensitive than traditional ones to the woes caused by the Covid-19 or other workplace changes. Additionally, these companies are typically not capital intensive ones, which means that their balance sheets are not highly indebted.

Furthermore, the index’s price-to-earnings ratio, a metric used to value the companies within it based on their earnings, is not necessarily too high, currently sitting at 23.5.

Finally, the absence of other attractive instruments that offer such a remarkable performance increases investor’s appetite for these companies, which ultimately results in a price boost over the long run.

This positive backdrop will likely favor tech stocks over the coming years as the global digital transformation continues at a fast pace, leaving diligent investors more profitable than they were before the pandemic.